The construction industry starts the year slowly

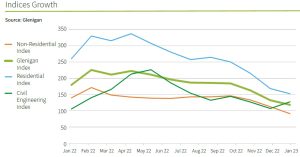

The latest construction industry insights show that there was a weak performance for most sectors over the last three months. According to Glenigan, there is a continued weakening in project start statistics… ‘31% decline in project starts against a year ago reflects investor caution in the face of a weak economic outlook’.

Residential, industrial and retail project starts suffered large falls in project starts in the three months to January. Plus, these sectors suffered a drop of 38%, 45% and 33% respectively against the same period a year ago. Meanwhile, civil engineering provides a relatively bright spot, with the value of project-starts up on the previous year.

Starts, awards and planning approvals are weak – Glenigan’s view

Glenigan reports that key indicators are looking gloomy in the February 2023 edition of Glenigan’s Construction Review.

Project starts plummeted 47% in the three months to January compared to the preceding three months. Project starts were also down a third compared to 12 months ago.

Main contract awards fell 21% against the preceding period, standing 16% lower than the same time a year ago.

Detailed planning approvals also look weak, down 17% overall on the preceding three months but flat compared to the year before. Underlying detailed planning approvals fell 10% compared to the same period a year ago.

Major projects have a stronger performance than a year ago

Glenigan’s 35-page report shows that although major detailed planning approvals fell 38% against the preceding 3 months, the value increased by 34% against the previous year. Plus, the value of major (£100m+) project contract awards fell 31% against the preceding 3 months, but was 17% higher year-on-year.

House building firms are reporting remarkably little change

Housebuilders say that there is little change in their results between 2021 and 2022. In fact, despite concerns over the housing market and the wider economy, major housebuilders are pressing on with applying for planning permission to build more homes. Developer confidence is higher in big regional cities such as Birmingham, Leeds and Manchester, where city living projects are feeding the construction industry.

Construction in the South East is outpacing other regions

Glenigan’s economics director Allan Wilén comments: “Despite wider economic concerns, there still appears to be confidence amongst clients in certain sectors in the South East.”

Construction started on a number of big projects in the South East last year including a £400 million redevelopment of Pinewood Studios (Project ID: 21007589). Plus there is Yondr Group’s £400 million One Data Campus development in Slough, where construction is due to start in March (Project ID: 21161150).

Concerns over the economy have sent the value of work entering the planning pipeline into reverse in many other regions, but Glenigan’s research shows that the South East is holding up. In the final quarter of 2022, the value of detailed planning applications for health work rose 65%, while approved hotel and leisure projects also rose 8%. These projects should move through the procurement cycle and help support the industry in the South East in the months ahead.

For more construction industry insights, subscribe to the Elland Steel newsletter.